In an era of competing NFT marketplaces, NFT royalties have fallen by the wayside.

Optional royalties were first popularized by Magic Eden, a dominant Solana NFT marketplace, after upstarts like Hadeswap quickly began capturing market share by employing zero-royalty models. Popular marketplaces LooksRare and Blur soon followed suit by making royalties an opt-in functionality for holders, with Blur enforcing royalties for creators only if other marketplaces (i.e., OpenSea) were blocked.

Zero royalties are a competitive differentiator in today’s relentlessly competitive landscape. Marketplaces that enforce royalties are often popular with creators because it enables access to a valuable revenue stream. At the same time, experienced holders and traders are increasingly migrating to zero-royalty marketplaces, as evidenced by Blur’s meteoric rise.

So how does this impact an NFT project’s roadmap and revenue model? Let’s dig into the data.

Understand User Behavior Through Royalty Breakdowns

Despite the growing tendencies of marketplaces to employ zero-royalty policies, there are still marketplaces that enforce creator royalties. The first step to navigating the changing marketplace landscape is to understand the behavior of your project’s holders and how it has changed as these marketplaces evolve.

- What is your current royalty collection rate, and how has it changed over time?

- Which marketplaces are your holders predominantly using?

- Which users are avoiding royalties?

- How many users are avoiding royalties?

- To what extent should royalties matter to your project?

These simple questions can yield insightful answers, but you’ll need the data to get started. NFT data analytics platforms like Helika make it easy to view the relevant information needed to capture deep insights that inform sound business decisions.

There are four main metrics for understanding royalty breakdowns:

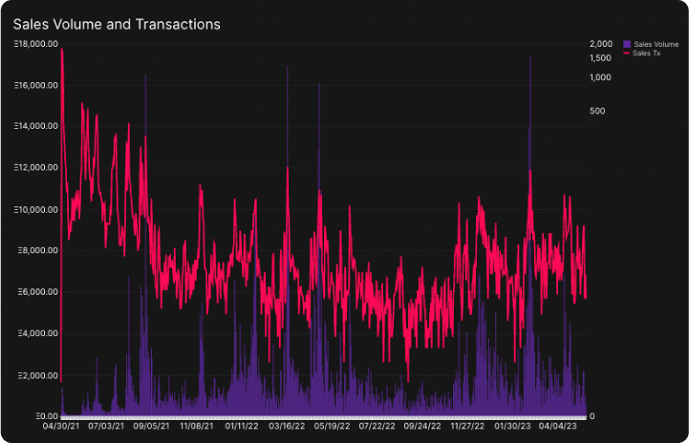

- Sales Volume and Transactions: This high-level metric informs the importance of royalties for your project. How much could your project be making in royalties, assuming full enforcement? It depends on this metric.

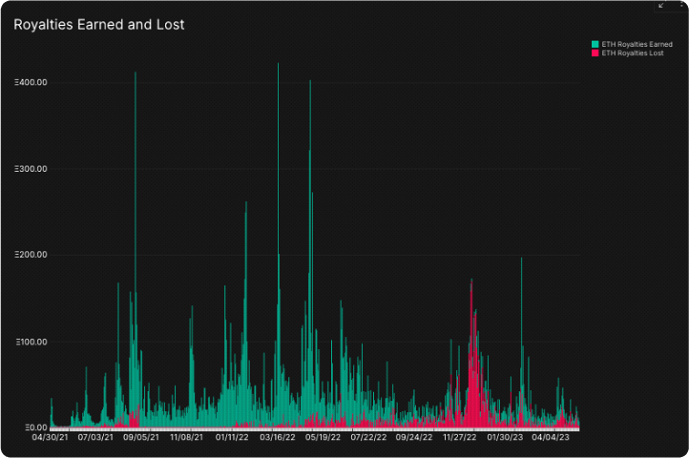

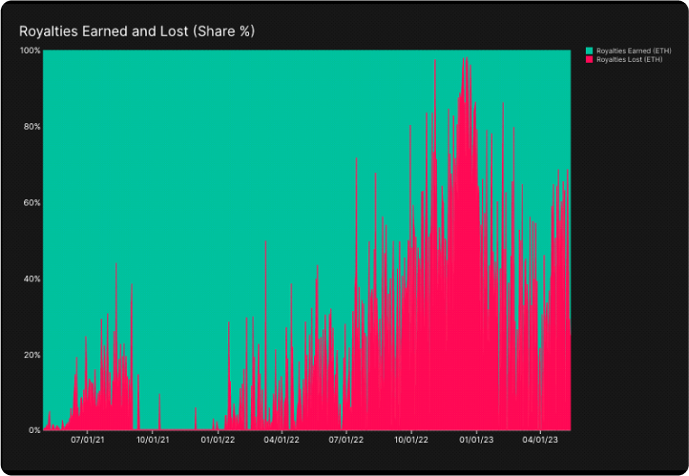

- Royalties Lost vs Royalties Earned: This metric calculates the extent to which royalties are being avoided by your holders, intentionally or unintentionally. It provides clear data on just how much your project is losing in royalties.

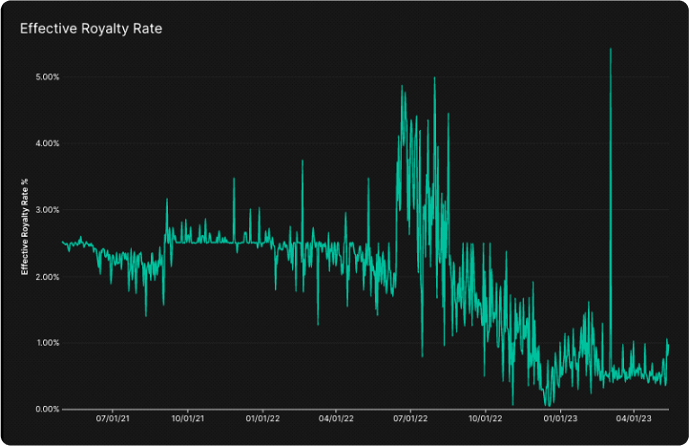

- Effective Royalty Rate: The effective royalty rate shows the effects of diminishing royalty rates for your NFT project—the percentage of royalties your project is losing over time due to marketplace competition.

- Marketplace Analytics: A host of metrics that provide you with insights into earned and lost royalties based on individual marketplaces, juxtaposed by total sales transactions for each.

Helika’s leading NFT data analytics platform makes it simple to analyze collection royalties at a glance using these metrics. Here’s an example.

Data Analysis: Bored Ape Yacht Club

Yuga Labs is the most prominent NFT creator in Web3, with iconic NFT collections like CryptoPunks, BAYC, MAYC, and Otherdeeds under their belt. Let’s start by using Helika to analyze the royalties of their first collection: Bored Apes (BAYC).

Bored Ape Yacht Club (BAYC)

Sales Transactions and Volume

BAYC NFTs have maintained a (generally) steady sales transaction and volume in the past few years, with drops that align with the aggregate decrease in market demand for NFTs.

Takeaway: If royalties are decreasing, royalty enforcement is the issue to focus on, rather than faltering demand.

Royalties Earned and Lost

The BAYC collection has continuously been losing more and more royalties, both in total numbers and in their percentage share. In the past months, the project has been losing ~10-20 ETH in royalty revenue per day, with spikes that can go as high as 100+ ETH.

Royalties earned (green) compared against royalties lost (red) for the BAYC collection.

Takeaway: BAYC is losing a significant amount in royalty revenue compared to the past, and this trend seems to be continuing.

Effective Royalty Rate

The effective royalty rate for BAYC NFTs has fallen from its general average of 3-4% in the past 6 months, and it now hovers around 0.5-1%.

Takeaway: The relationship between marketplace competition and BAYC’s royalty rate is clear—zero-royalty marketplaces are impacting the bottom line in a significant way.

Marketplace Analytics

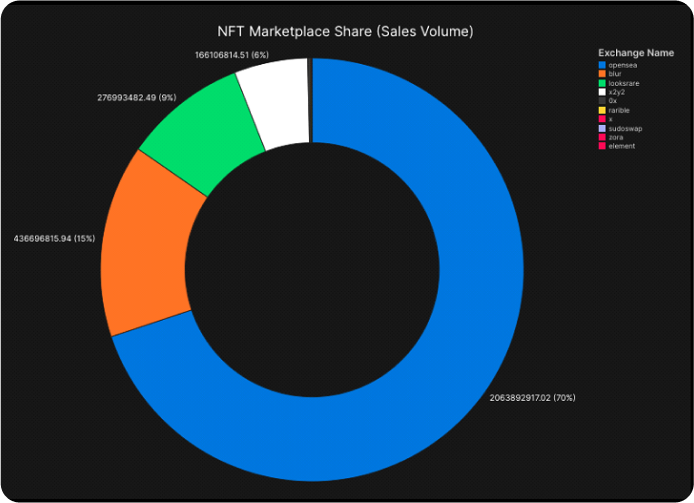

OpenSea represents 70% of BAYC’s sales volume, and it fully enforces royalties—a good sign for BAYC. While royalty revenues are down in the aggregate, users at large seem to prefer the brand recognition and easy UX of OpenSea and they accept its royalty enforcement.

OpenSea represents 70% of BAYC’s sales volume, and it fully enforces royalties—a good sign for BAYC. While royalty revenues are down in the aggregate, users at large seem to prefer the brand recognition and easy UX of OpenSea and they accept its royalty enforcement.

OpenSea is also the largest drive of royalty revenue (87%) compared to other marketplaces, indicating Yuga Labs should prioritize driving traffic to OpenSea rather than other marketplaces. Blur provides only 4% of royalty revenue despite representing 15% of BAYC’s marketplace share, which makes it a likely contributor to the decreasing effective royalty rate.

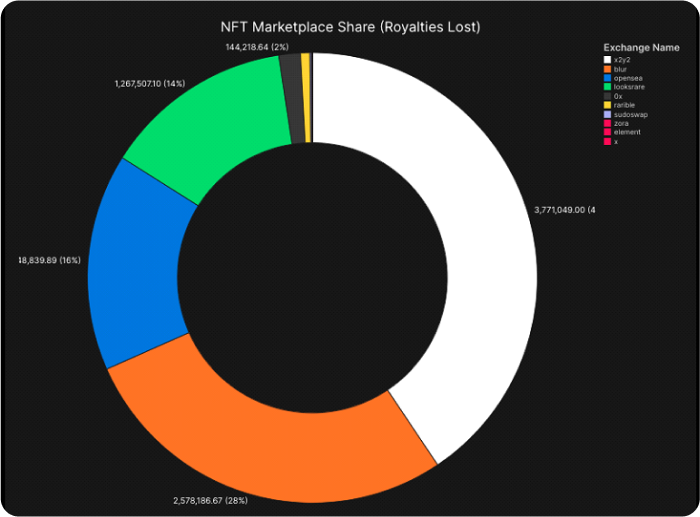

X2y2 is by far the largest (40%) culprit of lost royalties while representing a minuscule portion of sales volume (6%) in comparison to other marketplaces. LooksRare and Blur are significant contributors to both lost and earned royalties, making a deeper dive analysis necessary to understand their larger impact on royalties. OpenSea generates far more royalty revenue than it loses, once again making it the best marketplace for BAYC to collect royalties.

Takeaway: OpenSea is by far the most profitable marketplace for BAYC royalties, while x2y2 represents the lion’s share of lost royalties, especially relative to its sales volume

Strategies for Operating In a Zero-Royalty Environment

Given marketplace competition, it’s inevitable that royalties are trending downward: This is a trend across NFT projects.

That said, Yuga Labs is in a fairly good position when it comes to royalties. One data point that clearly stands out is OpenSea’s dominant presence in facilitating BAYC transactions despite its large royalty capture. This implies most BAYC holders generally don’t care about royalties.

Strategy 1: Market Top-Royalty Marketplaces

To capitalize on that fact, Yuga Labs should prioritize marketing the OpenSea collection and listings over other marketplaces—and that’s exactly what Yuga Labs does on boredapeyachtclub.com. The website lists only its OpenSea listings as a call to action for new buyers.

This strategy can be extrapolated to any NFT project with faltering royalties. By understanding which marketplaces are most profitable for your collection, and balancing that with where users predominantly transact, you can optimize the key funnels for existing and prospective holders to drive them to your preferred marketplace.

Strategy 2: Expand Primary Sales

One time-tested strategy for an already-popular NFT collection is to expand the IP and bring more NFTs to life. This naturally increases revenue generated from primary sales rather than royalties.

For example, Yuga Labs has launched a plethora of NFT collections that all exist in the Otherside metaverse—BAYC, MAYC, Kennel Club, Chemistry Club, and Otherdeeds, to name a few. They’ve also experimented with Bitcoin Ordinals, consumable NFT powerups for Dookey Dash, sold Otherside land NFTs, and more. The consistent release of new NFTs and optimizing for primary sales can help offset royalty losses and may provide another path for building a sustainable NFT project.

Strategy 3: Block Clear Losers

In the case of BAYC, most holders transact on OpenSea already, making the first strategy largely sufficient for operating in a zero-royalty environment. But many projects don’t have the popularity or ubiquity of BAYC, so what other strategies are possible for capturing more creator royalties?

Another strategy is to block clear losers when applicable. This is heavily dependent on your NFT project’s community—blocking a marketplace due to low royalties may be a net negative in the long run if there is significant community backlash. But this strategy could be valuable in cases like BAYC and x2y2, where the marketplace facilitates very few transactions compared to competitors while also representing a large share of lost royalties.

Strategy 4: Enforce Royalties at the Smart Contract Level

One emergent strategy that upcoming NFT projects are best suited to adopt is to enforce royalties at the smart contract level with LimitBreak’s NFT royalty enforcement token standard, ERC721-C.

Given the nascency of this token standard, it’s unclear how an NFT user will react to a collection that starts with immutable royalty enforcement. However, upcoming NFT projects can completely sidestep the continuous decrease in NFT royalties by simply enforcing it, at the start, from the smart contract level. It’s also possible to lessen the potential community backlash of this kind of implementation by playing around with different royalty models, such as sharing royalties to minters.